Check Your Tax Refund Status Easily: IRS Tool & Tips

Are you eagerly awaiting your tax refund, wondering when that welcome sum will arrive in your bank account? Navigating the intricacies of tax refunds can be daunting, but understanding the tools and resources available to track your refund can provide much-needed clarity and peace of mind.

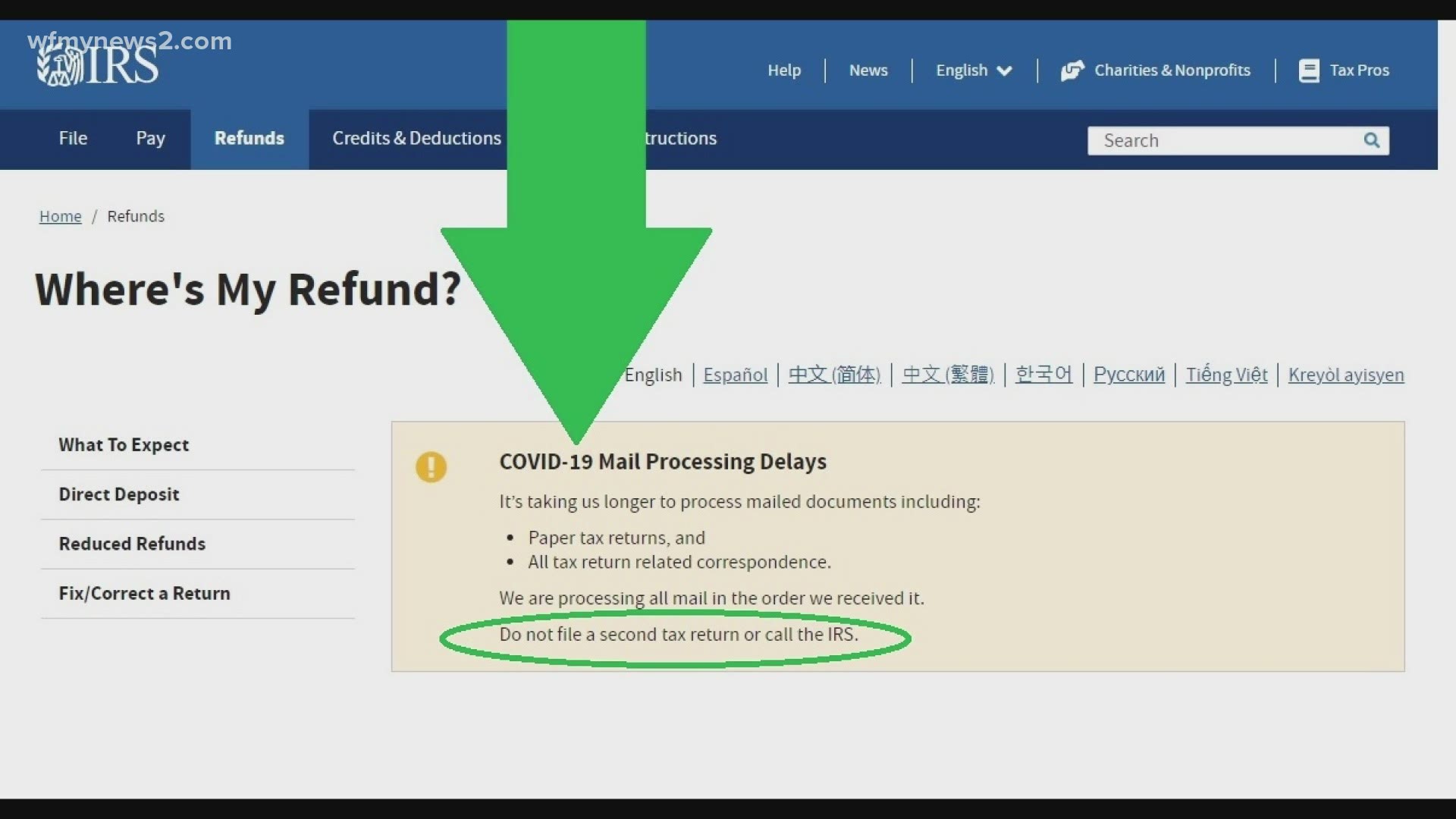

The Internal Revenue Service (IRS) understands the importance of timely refunds. They've developed user-friendly tools to assist taxpayers in monitoring their refund status. One of the primary resources is the "Where's My Refund?" tool, accessible on the IRS website (IRS.gov) and through the IRS2Go mobile app. This tool provides real-time updates on your refund's progress through three distinct stages: return received, refund approved, and refund sent. The IRS strives to issue most refunds within 21 calendar days, but its crucial to remember that certain circumstances can lead to delays.

To access this valuable information, you will need to provide some key details from your most recent tax return. Specifically, you'll be asked to enter your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN), your filing status (e.g., single, married filing jointly), the tax year, and the exact refund amount as it appears on your tax return. All fields are marked with an asterisk (*), indicating they are mandatory for a successful search.

The "Where's My Refund?" tool is not just a simple tracker; it provides a personalized date once your return has been processed and your refund approved. It's important to note that the information provided by the "Where's My Refund?" tool is the same information available to IRS phone representatives. Therefore, it's the most direct and reliable source for your refund status.

Here's a breakdown of essential details and information about the IRS refund process. This table provides a comprehensive overview for understanding your tax refund status:

| Category | Details |

|---|---|

| Tool Name | Where's My Refund? |

| Availability | IRS.gov website and IRS2Go mobile app |

| Information Required | Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN), Filing status, Tax year, Exact refund amount |

| Tracking Stages | Return Received, Refund Approved, Refund Sent |

| Typical Processing Time | Most refunds issued within 21 calendar days |

| Amended Returns | Use "Wheres My Amended Return?" to track an amended return. |

| Paper Returns | Information may not be available immediately for paper returns, particularly for current-year homestead credit refunds (available from July). |

| Multilingual Support | Available in English and Spanish. |

| Security | Secure system monitored by the IRS for protection. |

| Reference Website | IRS.gov |

Understanding potential delays is also crucial. While the IRS aims for a 21-day turnaround, several factors can prolong the process. These include errors on your return, incomplete information, or the need for additional review. If your return requires further scrutiny, such as identity verification or a request for additional documentation, it will naturally take longer. Filing a paper return can also add to the processing time, as it involves manual handling and review. Moreover, claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) may result in a longer processing period, as the IRS is required by law to hold refunds related to these credits until mid-February.

The IRS continually reminds taxpayers to use the "Wheres My Refund?" tool. It's a critical resource for confirming the receipt of returns and tracking the refund's progress. Taxpayers can generally start checking the status of their refund within 24 hours after e-filing or four weeks after mailing a paper return. In mid-March of the recent year, the IRS had already sent out nearly $163 billion in tax refunds. To further assist taxpayers, the IRS provides information and resources on its website and mobile app, including FAQs and helpful tips to navigate the tax process.

The IRS2Go app is another convenient tool for checking your refund status, offering similar functionality to the "Where's My Refund?" tool on the IRS website. This app allows you to track your refund, access tax information, and stay updated on tax-related news and alerts.

For those who need to amend a tax return, the IRS provides a separate tool called "Wheres My Amended Return?". This tool allows taxpayers to check the status of their amended returns. Please note that it can take up to three weeks after filing an amended return for its status to be available online.

The IRS offers various resources to help you understand and meet your federal tax responsibilities. You can find IRS forms, answers to tax questions, and other valuable information on their website. The IRS also stresses the importance of accurate and complete tax filings. Ensure all information is correct to avoid delays in processing your return and receiving your refund. Remember that the information provided by these tools is the same information accessible to IRS phone representatives.

When using "Where's My Refund?", it's essential to have specific information at hand. You'll need your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN), your filing status, and the exact refund amount as shown on your tax return. The system is secure and monitored by the IRS for your protection. After you have finished accessing your refund status, it is recommended that you close your browser for security reasons.

The IRS encourages taxpayers to use the "Where's My Refund?" tool to track their refunds and to confirm receipt of their tax returns. It's a user-friendly tool accessible on IRS.gov and the IRS2Go mobile app, offering updates through each stage of the refund process. Remember to have your Social Security number (SSN), filing status, and refund amount ready to use the tool effectively.

Whether you're checking online, using the IRS2Go app, or calling the IRS's refund hotline, the information provided by the IRS remains consistent. The IRS issues most refunds in 21 calendar days, but this can vary. If you filed a paper return, the processing time may be longer.

The IRS works diligently to process tax returns accurately and issue refunds as quickly as possible. By utilizing the tools and resources provided, taxpayers can stay informed about the status of their refunds and manage their expectations accordingly.

The IRS is committed to helping you understand and meet your federal tax responsibilities. Their website provides resources for tracking your tax refund and other essential tax-related information. The IRS remains available to help taxpayers via phone.

For many Americans, receiving a tax refund is a welcome financial boost. Understanding how to track your refund and knowing when to expect it can alleviate some of the stress that often accompanies the tax season. The IRS's "Where's My Refund?" tool, along with the IRS2Go app, provides a straightforward way to monitor the progress of your refund and stay informed about its status.

The IRS reminds taxpayers to use the "Wheres My Refund?" tool on IRS.gov to confirm the receipt of their return and track a refund. Also, taxpayers can check their refund status online or with IRS2Go app.

The IRS aims to issue most refunds in 21 calendar days. You can check the status of your refund with the Wheres My Refund? tool or the IRS2Go mobile app. The "Wheres My Refund?" tool is available on IRS.gov or the IRS2Go mobile app, where taxpayers can track their refund through three stages.